Uniquely designed with Uber Carshare, KOBA’s car share owner-use comprehensive product offers car share owners pay-per-km insurance when they’re using their car.

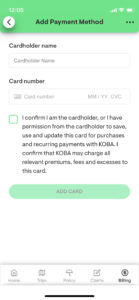

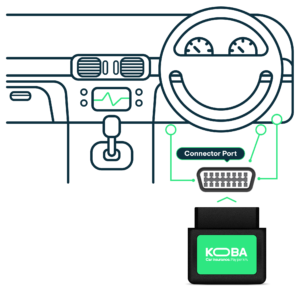

What is the Uber Carshare device?

KOBA works with Uber Carshare’s Instant Keys GPS device. Synced with Uber Carshare’s Instant Keys technology, the GPS device automatically switches between KOBA and Uber Carshare. Our integrated tech distinguishes when your car is used for personal use and measures the KM you drive so you only pay for the insurance you use.

Uber Carshare will send the Instant Keys GPS device to you when you become a Uber Carshare member and order the “Instant Keys” option. This may take 5-7 days to arrive. Learn more.

Can I start driving without it?

If your policy cover has started and you haven’t yet received your Instant Keys kit from Uber Carshare, you can keep driving per usual. We’ve got you covered from your policy start-date.

How do you charge my per-km rate without my GPS device?

While you’re waiting for your GPS device to arrive and to activate your vehicle data, we use the estimated annual usage you told us when you took out your policy to charge your Driving premium. This estimated usage is charged from your cover start-date and will appear in the ‘your trips’ section of the app while you wait for your GPS device from Uber Carshare to arrive.

Once your GPS device is plugged in, your own trips will appear and you’ll start paying for actual KM used.

What if I already have my GPS device plugged in when I take out my KOBA policy?

Great! If you’re already a Uber Carshare member and have your GPS device plugged in when you take out your KOBA policy, you’re all set. The GPS device will automatically distinguish when the car is used for personal use and start charging you your unique per-KM rate. Log onto the KOBA app to start seeing your trips and costs daily.

Heads-up //

/ When you first sign up to KOBA, you have 14 days to receive and plug in your Instant Keys GPS device so it begins transmitting a signal. If we don’t receive a connection from your device, within 14 days by default, your policy will charge you the maximum daily amount (250 km/day). Please make sure you have the GPS device plugged in and connected by the 21st day; otherwise you may be at risk for automatic cancellation.